Updated on:

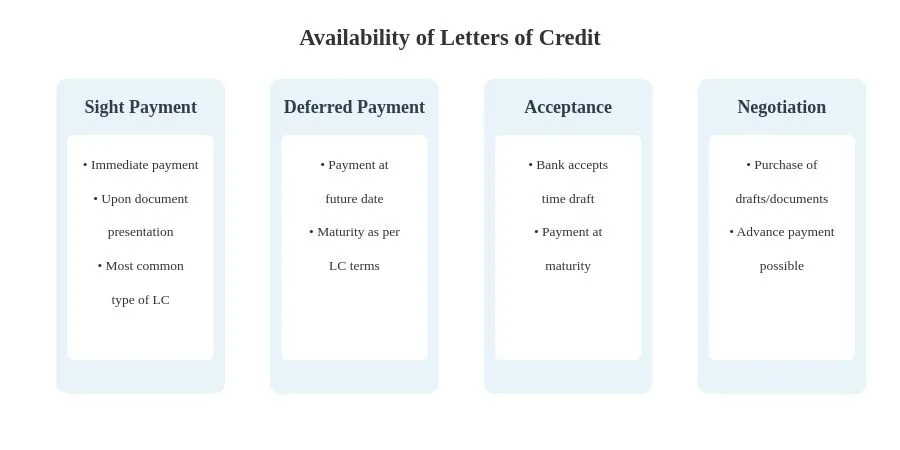

Letters of Credit are flexible instruments because they incorporate various payment options.

According to letter of credit rules, a credit must state whether it is available by sight payment, deferred payment, acceptance or negotiation. (UCP 600 – Article 6- b)

The credit must explicitly indicate its availability as: (i) immediate payment (sight), (ii) payment at a future determinable date (deferred), (iii) acceptance of a time draft drawn on the issuing, nominated bank, or confirming bank, or (iv) negotiation with or without recourse to the beneficiary.

Sight payment ensuring prompt payment upon document compliance. Deferred payment, allowing for payment at a future date. Acceptance LCs involve the bank’s commitment to pay at a later date via draft acceptance. Negotiation LCs offer the possibility of receiving early payment by discounting drafts.

What does availability mean in a letter of credit transaction?

In documentary credit terminology, availability refers to the availability of the documents in exchange for the payment of the amount stated in the letter of credit.

UCP 600 defines four availability options.

- Sight payment

- Deferred payment

- Acceptance

- Negotiation

Sight Payment:

Sight payment refers to the payment which is made as soon as the complying presentation is acknowledged by the issuing bank or the bank nominated in the letter of credit.

The nominated bank fulfills its payment obligation with recourse basis.

Which means that the nominated bank can demand the amount paid to the beneficiary back, in case of documents are found non-complying by the issuing bank.

Nominated bank’s payment obligation is not strict; as oppose to the issuing bank’s payment obligation or the confirming bank’s payment obligation.

UCP 600 states that a nominated bank is not obligated to accept the nomination directed to itself, unless the nominated bank informs its acceptance of nomination expressly to the beneficiary.

Even in this situation, UCP 600 assumes non-payment by the nominated bank and describe the roles of the issuing bank and the confirming bank, when nominated bank refuses to make payment to the beneficiary.

At Sight Payment Example: The nominated bank receives the documents Monday, May 2. On May 5 the bank decides, after examining the documents, that they comply with the terms and conditions of the LC and makes the payment value date Monday, May 9. (Source: Documentary credits, collections and bank guarantees, page: 15)

Deferred Payment:

Deferred payment refers to the payment which is made after a period of time that is specified also in the letter of credit.

The payment period is usually determined as specific number of days after the date of presentation or the date of the transport document.

Bill of exchange or draft is not required under deferred payment.

Deferred Payment Example: The LC is payable 60 days after loading the goods on board the ship. The nominated bank receives the documents on May 2. On May 5 the bank decides, after examining the documents, that they comply with the terms and conditions of the LC. According to the bill of lading the goods were loaded on board April 12. The bank is obligated to pay the beneficiary on June 11. (Source: Documentary credits, collections and bank guarantees, page: 15)

Acceptance:

Acceptance refers to acceptance of a bill of exchange, which is drawn on the bank mentioned in the letter of credit, to be presented along with the other required documents and payment at the maturity.

Acceptance under a Letter of Credit (L/C) refers to the acknowledgment and commitment by the issuing or nominated bank to pay a bill of exchange (also known as a draft) on its maturity date. This typically occurs when the L/C is issued as a time or usance credit, meaning payment is due at a future date rather than immediately upon presentation of documents.

Acceptance Payment Example: A Belgian exporter sells industrial washing machines to a Saudi Arabian importer under a Letter of Credit (L/C). The payment terms are set to be 90 days after shipment by acceptance, allowing importer time to sell the machines before making the payment. The seller can also discount the draft after it is accepted by the issuing bank or confirming bank.

Negotiation:

Let us check the definition of the negotiation from the UCP 600 in order to understand the term more clearly.

Negotiation means the purchase by the nominated bank of drafts (drawn on a bank other than the nominated bank) and/or documents under a complying presentation, by advancing or agreeing to advance funds to the beneficiary on or before the banking day on which reimbursement is due to the nominated bank. (UCP 600 – Article 2)

As can be seen from the above definition, any letter of credit which is available by negotiation could be issued in a way so that a draft may or may not be required.

Also, the payment of the letter of credit may or may not be at sight.

If the nominated bank advance or agreeing to advance funds to the beneficiary, before it receives reimbursement from the issuing bank the negotiation condition is fulfilled.

This can be happened in two different ways.

First option is possible under a letter of credit which is available by sight payment, when the nominated bank reimburses the beneficiary before it receives funds from the issuing bank.

Second possibility occurs when a letter of credit is available by negotiation requesting presentation of a time draft, while the nominated bank reimburses the beneficiary before the maturity date of the bill of exchange.

ÖZGÜR EKER (CDCS)

Letter of Credit Consultancy Services