United States is the 2nd largest exporter of goods in the world.

As of 2020, the United States is a major player in the global export market, ranking as the second-largest exporter in the world with a total export value of USD 1.34 trillion.

US exports represents a decline of USD 49.7 billion from the USD 1.39 trillion in exports reported in 2015.

Refined petroleum is the leading export from the United States, with a value of USD 58.4 billion, followed by crude petroleum at USD 52.3 billion, cars at USD 47.6 billion, integrated circuits at USD 44.2 billion, and petroleum gas at USD34.7 billion.

The United States’ primary export partners are Canada, Mexico, China, Japan, and Germany.

Canada is the top destination for U.S. exports, with a value of USD 218 billion, followed closely by Mexico at USD 196 billion. China, Japan, and Germany round out the top five destinations for U.S. exports, with values of USD 122 billion, USD 63.1 billion, and USD 59.2 billion, respectively.

United States is the largest importer of goods in the world.

As of 2020, the United States ranked as the world’s top trade destination, with a total import value of USD 2.24 trillion.

Over the past five years, the country’s imports have increased by USD 127 billion, rising from USD 2.12 trillion in 2015 to USD 2.24 trillion in 2020.

The leading imports of the United States are Cars (USD 144 billion), Computers (USD 92.4 billion), Packaged Medicaments (USD 84.1 billion), Broadcasting Equipment (USD 82 billion), and Crude Petroleum (USD 75.1 billion).

China, Mexico, Canada, Germany, and Japan are the most common import partners for the United States, with import values of USD 438 billion, USD 326 billion, USD 264 billion, USD 116 billion, and USD 112 billion, respectively,

Letter of Credit Usage:

Letter of credit (LOC) is a payment method used in international trade.

Although some exporters view it as a complex, time-consuming, expensive, and stressful, it remains as an essential tool in certain situations.

In some countries such as Bangladesh, Algeria, Egypt, Nepal, Ethiopia, etc., the use of LOC is compulsory either in full or part of their imports.

Therefore, it is impossible to avoid LOC in these circumstances.

Additionally, commercial conditions may also dictate the use of LOC, despite its perceived disadvantages.

What We Offer:

What we offer to our customers is a top class, reliable and cost-effective letter of credit consultancy and document preparation services.

All technical details of the export letter of credit transaction are handled by us.

You will save time and money.

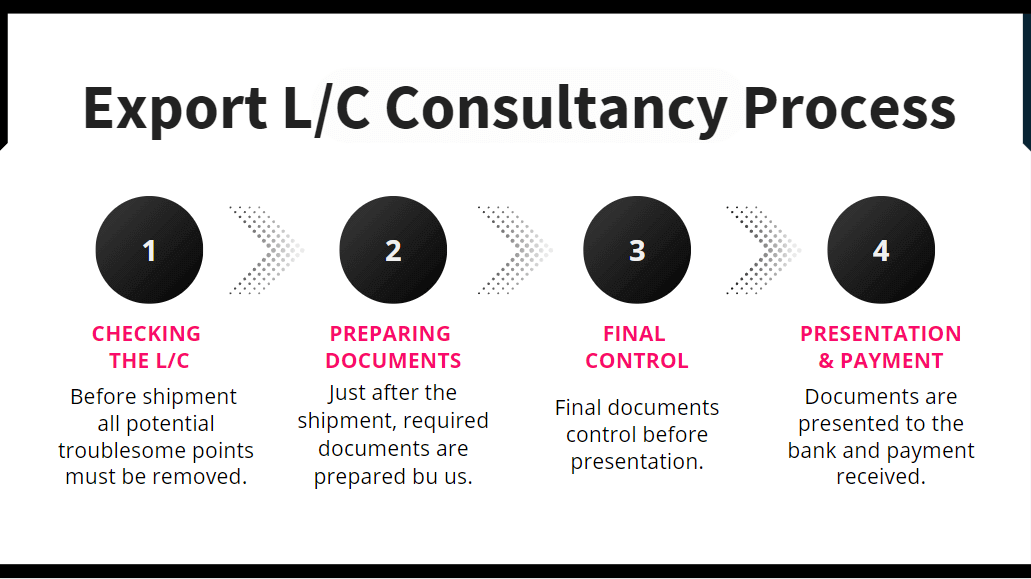

- We Check the Letter of Credit:

Export letter of credit consultancy service starts with L/C check. Before shipment all potential troublesome points must be removed from the L/C.

How to Check a Letter of Credit as an Exporter?

If you want to check letter of credit by yourself, you can benefit from our related article above.

- We Prepare Draft Documents:

After shipment, we prepare letter of credit documents according to letter of credit terms and conditions.

Letter of Credit Documents

Letter of credit documents change from one presentation to another, but you can find main document types from our related article above.

- Final Control of Documents:

Our customers send us back scanned version of all documents signed and stamped for final check before presentation them to the nominated or confirming bank.

After we make sure that documents are complying the presentation process of documents is completed.

Top 10 Letter of Credit Discrepancies

You can find the most common discrepancies that definitely you must avoid under export letter of credit transactions.

- Presentation and Payment:

We will guide our customers until they receive their payments under the letters of credit.

Availability of Letters of Credit

You can understand different payment availabilities under letter of credit transactions from our related article above.

References:

We have completed hundreds of presentations for the last 13 years and success rate is %100. All our customers received their payments under our services.

Here are some of our works. You can click heading parts for more details of each transaction.

Note: We do not share any details of our customers even their names. Only harmless data shared below.

India Export Letter of Credit Consultancy

Total letter of credit amount was USD 680.004,52. Letter of credit confirmed by JP Morgan Chase Bank, N. A., New York, USA. Beneficiary located in U.S.A. and applicant resident in India.

Senegal Export Letter of Credit Consultancy

Total letter of credit amount was EUR 803.400,84. Letter of credit confirmed by Bred Banque Populaire Paris France. Beneficiary located in U.K, applicant in Senegal and manufacturer in Turkey.

Kenya Export Letter of Credit Consultancy

Total letter of credit amount was EUR 57.605,67. Documents have been accepted by the issuing bank on first presentation.

Morocco Export Letter of Credit Consultancy

Total letter of credit amount was USD 46.620,00. All presentations have been accepted by the issuing bank on first presentation.

Qatar Export Letter of Credit Consultancy

Total letter of credit amount was USD 617.750,00. Although the exporter contacted us very late, we managed to put things in order and completed the transaction without any problem for each side.

Libya Export Letter of Credit Consultancy

Total letter of credit amount was USD 20.345,00. Documents have been accepted by the issuing bank on first presentation.

Israel Export Letter of Credit Consultancy

Total letter of credit amount was USD 109.186,09. The beneficiary completed shipments via 3 partial shipments.

Contact Us:

You can contact us by simply sending an email or filling contact us form on this page.