Although letter of credit is a balanced payment method in terms of risk issues for both exporters and importers, each letter of credit party bears some amount of risk; higher or lower.

For the seller, the primary concern lies in the financial stability and trustworthiness of the issuing bank, often located in a distant country and potentially unfamiliar to them.

Conversely, the buyer faces the risk of paying for goods that may be unsatisfactory, substandard, or even non-existent, as well as uncertainties surrounding the documents presented.

As I have explained on my previous post, letters of credit transactions are handled by banks, which make banks one of the parties that bears risks in l/c transactions in addition to exporters and importers.

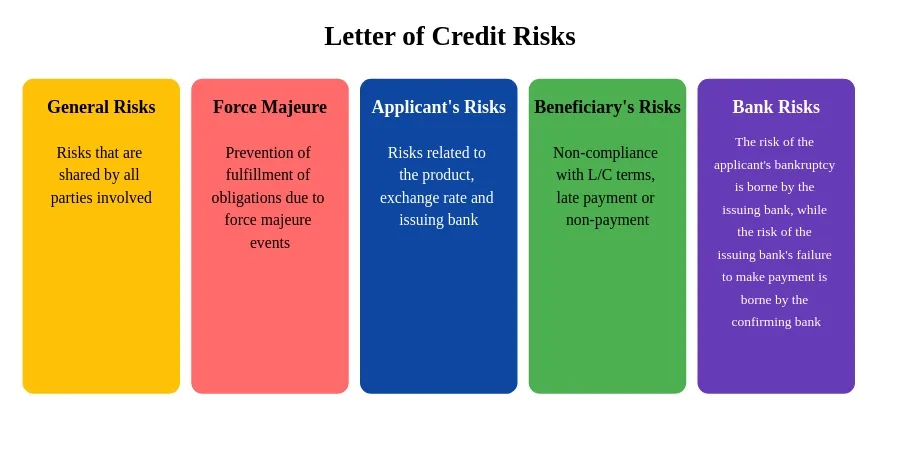

Risks in letters of credit can be discussed under four groups: general risks, risks to the applicant, risks to the beneficiary and risks to the banks.

On this post each risk group will be examined in detail with real life examples.

General Risks in Letters of Credit:

Country Risk: (Political Risk)

The first risk factor that can be mentioned in the general risks group is the country risk or the political risk.

Let us assume that we are an exporter located in a country X, and we have a customer from the country Y.

Our customer, which is from the country Y, opened an L/C in favor of us. We have checked the L/C conditions, and they seem workable.

We have produced and shipped the order as per the L/C and transmit the required documents to the issuing bank before the expiry date.

The issuing bank found our presentation complying and informed us that they will be honoring our payment claim at the maturity date.

However, before the maturity date due Country Y has changed its export regime, which makes it impossible for the issuing bank to honor our presentation.

This illustrative case is a good example of country risks.

Other examples of country risks are mass riots, civil war, boycott, sovereign risk and transfer risk.

Country Risk Example:

During Libyan Civil War in year 2011, hundreds of exporters could not receive their payments as international community blocked Libyan Government’s funds in major currencies such as US Dollars and Euros.

Fraud Risk:

As we have described before all conditions stated in a letter of credit must be connected to a document, otherwise banks will disregard such a condition.

In addition, banks deal with only documents but not goods, services or performance to which the documents may relate.

This feature of the letters of credit is the source of the fraud risk at the same time.

As an example, a beneficiary of a certain letter of credit transaction can prepare fake documents, which looks complying on their face, to make the presentation to the issuing bank.

As the documents are complying on their face, the issuing bank may honor the presentation and, in this case, the applicant must pay to the issuing bank for the goods it will never be receiving.

Beneficiaries of L/Cs are also open to significant amount of fraud risks.

This happens if an applicant issues a counterfeit letter of credit. In this case, the beneficiary never receives its payment for the goods it has shipped.

Fraud Risks Example:

UK steel giant, which was very close to bankruptcy at the time when the business occurs, has received funds under a letter of credit issued from Algeria via fake documents.

Risks to the Applicant:

In a letter of credit transaction, main risk factors for the applicants are non-delivery, goods received with inferior quality, exchange rate risk and the issuing bank’s bankruptcy risk.

Risks to the Beneficiary:

In a letter of credit transaction, main risk factors for the beneficiaries are unable to comply with letter of credit conditions, counterfeit L/C, issuing bank’s failure risk and issuing bank’s country risk.

Risks to the Banks:

Every bank in a L/C transaction bears risks more or less. The risk amount increases as responsibility of the bank increases.

The risk of the applicant’s bankruptcy is borne by the issuing bank, while the risk of the issuing bank’s failure to make payment is borne by the confirming bank.

ÖZGÜR EKER (CDCS)

Letter of Credit Consultancy Services