Updated on:

When an irrevocable letter of credit is issued, the risk of payment rests with the issuing bank. This type of letter of credit is defined as an unconfirmed letter of credit.

However, in certain circumstances, the exporter may find the issuing bank not fully trustworthy and/or the country where it is located has high political or economic uncertainty.

In this situation, the exporter should consider requesting a confirmed letter of credit.

Confirmation is a security tool for the exporters. Confirmation eliminates country risks and insolvency risks of the issuing bank.

With a confirmed letter of credit, another bank, the confirming bank, usually located in the same country that the exporter is located, will add its confirmation to the letter of credit.

By adding its confirmation, the confirming bank undertakes to honour the exporter’s claim under the letter of credit, provided all terms and conditions of the letter of credit are met. (1)

What are the benefits of a confirmed letter of credit?

As I have discussed earlier, there are some risk factors exist for each party in a letter of credit transaction.

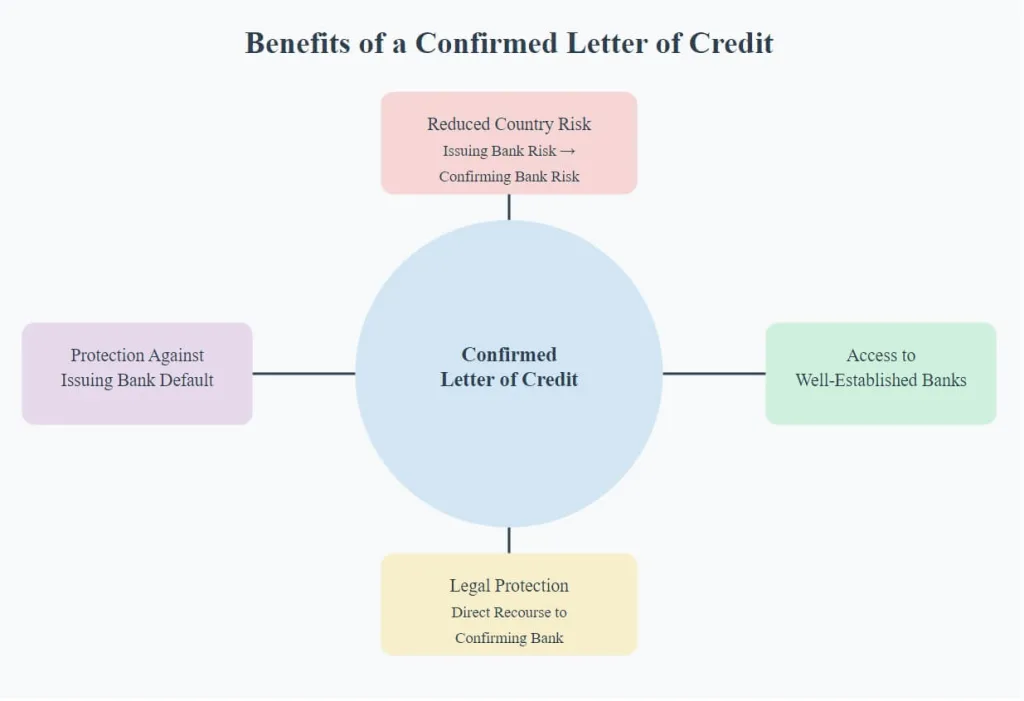

When we look at the risk issue from the beneficiary’s perspective, we will observe two main risk factors that beneficiaries must bear; the country risk and the insolvency risk of the issuing bank.

Confirmation can be seen as a security mechanism, which works in favor of the beneficiary to eliminate these risk factors.

Advantages of Confirmed Letter of Credit in Terms of Country Risk:

In confirmed letters of credit, the country risk of the issuing bank is replaced by the country risk of the confirming bank.

For example, when a bank in Germany confirms a letter of credit issued from Kenya, the exporting company avoids the country risk of Kenya.

Avoiding the Issuing Bank’s Bankruptcy Risk:

By adding confirmation to the letter of credit, the exporting company avoids the risk of the issuing bank in a risky country going bankrupt or being unable to pay the letter of credit amount.

Opportunity to Work with Well-Established Banks:

With the confirmation mechanism, exporting companies have the opportunity to work with more well-established banks.

Responsibility of the Confirming Bank in Legal Processes:

In certain legal processes, the exporting company can address the confirming bank.

What is a confirmation?

Let us look at the definitions of confirmation and confirming bank from the UCP 600.

- “Confirmation means a definite undertaking of the confirming bank , in addition to that of the issuing bank, to honour or negotiate a complying presentation.”

- “Confirming bank means the bank that adds its confirmation to a credit upon the issuing bank’s authorization or request.”

As can be seen on the above definitions, confirming bank adds its undertaking to the letter of credit in addition to that of the issuing bank.

In this way, the beneficiary receives a second payment guarantee from another bank.

Insolvency risk of the issuing bank is eliminated by addition of this second payment guarantee to the letter of credit.

Mostly, the confirming bank and the beneficiary are located in the same country.

If this is the case, the country risk of the issuing bank is eliminated, because a bank which locates in the same country with the beneficiary adds its payment undertaking to the letter of credit in addition to that of the issuing bank.

Key Points of a Confirmed Letter of Credit

After discussing the benefits of the confirmation in a letter of credit transaction, let us examine the key points that need to be taken into consideration regarding the confirmed letter of credit.

- Only irrevocable letters of credit can be confirmed.

- During the issuance phase of a letter of credit, the issuing bank should “authorize or request” the potential confirming bank to add its confirmation to the letter of credit.

- No bank can be forced to add its confirmation to any letter of credit.

If a bank is authorized or requested by the issuing bank to confirm a credit but is not prepared to do so, it must inform the issuing bank without delay and may advise the credit without confirmation. (UCP 600 article 8 ii-d) - Confirming a letter of credit does not mean that confirming bank is obligated to confirm any subsequent amendment or amendments.

- A confirming bank is irrevocably bound to honour or negotiate as of the time it adds its confirmation to the letter of credit. (UCP 600 article 8 ii-b)

Sources:

- A Guide to Letters of Credit, TD Securities, page: 24

ÖZGÜR EKER (CDCS)

Letter of Credit Consultancy Services