Germany is a country in Central and Western Europe, lying between the Baltic and North Seas to the north, and the Alps to the south.

Germany borders Denmark to the north, Poland and the Czech Republic to the east, Austria and Switzerland to the south, France to the southwest, and Luxembourg, Belgium and the Netherlands to the west. (1)

International trade has been playing a key role on German economy for centuries.

Germans are famous for their quality products. “Made in Germany” is a reliable quality mark and is a strong reason of choice to buy a product all around the world.

In Germany the share of industry in gross value added is 22.9 per cent, making it the highest among the G7 countries.

The strongest sectors of Germany are vehicle construction, electrical industry, engineering and chemical industry.(2)

Germany is a member of the European Union and using EU’s currency EURO (EUR) since 2002.

German economy is the driving force of the European Union economy. Other European countries rely on Germany to keep their economies and finances functioning properly.

On this page you can find brief information in regards to German economy, key points of its international trade, banks in Germany and letter of credit usage tips specific to Germany.

Letter of Credit Services for German Exporters

Letter of Credit Services for German Exporters

We will be more than happy helping German exporters with their letter of credit transactions.

Small or big, every customer welcomes. We mainly work with manufacturing companies.

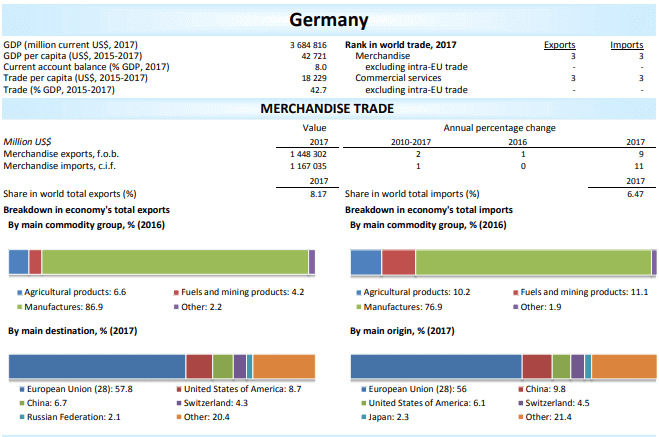

Germany Exports at a Glance:

Germany is an exporting machine. Germany experiencing trade surpluses for decades.

In binary trade relations, Germany exports more than its imports from majority of countries all around the world with limited exceptions such as China, Saudi Arabia etc…

As of 2017 Germany is the 3rd biggest exporting country in the world. Germany’s 2017 exports declared as 1 trillion 420 billion US dollars in value.

Breakdown of Germany’s total exports by main commodity groups are: agricultural products %6.6, fuels and mining products %4.2, manufactures %86.9.

The most significant export destinations of Germany are European Union %57.8, the United States of America %8.7, China %6.7, Switzerland %4.3 and Russian Federation %2.1.

Top Exported Products of Germany (2017)

| Agricultural Goods | Non-Agricultural Goods |

|---|---|

| Chocolate and other cocoa food | Motor cars for transport of persons |

| Swine meat, fresh, chilled, frozen | Parts for motor vehicles 8701-8075 |

| Cheese and curd | Medicaments in measured doses |

| Bread, pastry, other bakers' wares | Other aircraft |

| Other food preparations | Human and animal blood |

Germany Imports at a Glance:

Germany is the 3rd top importing country as of 2017 statistics. The import trade value of Germany in 2017 declared as USD 1 trillion 167 billion.

Breakdown of Germany’s total imports by main commodity groups are: agricultural products %10.2, fuels and mining products %11.1, manufactures %76.9.

Germany’s major import trading partners are European Union, China, the United States of America, Switzerland and Japan.

Banks in Germany

Deutsche Bank: Deutsche Bank, which is one of the biggest banks in Germany, was founded in 1870. Deutsche Bank has a strong position in Europe and a significant presence in the Americas and Asia Pacific.

SWIFT Code: DEUTDEFF

Commerzbank: Commerzbank is a leading international commercial bank with branches and offices in almost 50 countries. Commerzbank finances approximately 30% of Germany’s foreign trade and is leading in financing for corporate clients in Germany.

SWIFT Code: COBADEFF

KfW Bankengruppe: Founded in 1948, KFW Bankgruppe is a Government-owned development bank. Kreditanstalt Fuer Wiederaufbau – KFW operates as a promotional bank. It provides financing for investments, projects by German and European companies, and for economic and social initiatives in developing countries, as well as advisory services.(3)

SWIFT Code: KFWIDEFF

HypoVereinsbank (UniCredit Bank AG) : HypoVereinsbank is one of the leading private banks in Germany. HypoVereinsbank is a subsidiary of UniCredit Group.

UniCredit Bank AG (HVB), formerly Bayerische Hypo- und Vereinsbank Aktiengesellschaft headquartered in Munich, was formed in 1998 through the merger of Bayerische Vereinsbank Aktiengesellschaft and Bayerische Hypotheken- und Wechsel-Bank Aktiengesellschaft. It is the parent company of HVB Group. HVB has been an affiliated company of UniCredit S.p.A., Milan, Italy (UniCredit), since November 2005 and

hence a major part of the UniCredit corporate group as a subgroup. (4)

SWIFT Code: HYVEDEMM

Landesbank Baden-Württemberg: Headquartered in Stuttgart, LBBW is one of the biggest banks in Germany with total assets worth EUR 238 billion. LBBW is owned by the Federal State of Baden-Württemberg, the Savings Bank Association of Baden-Württemberg and the City of Stuttgart.

SWIFT Code: SOLADEST

Bayerische Landesbank (Bayern LB): Bayerische Landesbank is a publicly regulated bank based in Munich, Germany and one of the eight Landesbanken. It is 94% owned by the free state of Bavaria and 6% owned by the Sparkassenverband Bayern, the umbrella organization of Bavarian Sparkassen.

With a balance of €416 billion and 19,200 employees (in the group; 5,170 in the bank itself), it is the eighth-largest financial institution in Germany.(5)

SWIFT Code: BYLADEMM

Letter of Credit Usage Tips Specific to Germany:

Tips to the Importers:

- Germany has very limited natural resources.

- German companies are exporting almost all types of manufacturing goods. They are very good at quality.

- German banks are very strong both in terms of capital ratios and international establishment.

- Working with German exporters should not possess any significant risk factors for the importers.

- Try to establish a simple and well defined letter of credit in order to complete the transaction smoothly.

Tips to the Exporters:

- Germany has a low political and credit risks, a very robust banking sector and an excellent business climate.

- As a result accepting a letter of credit issued by a German bank should not inherit any additional risks. Following standard letter of credit control procedures and conducting a simple fraud risk examination should be sufficient.

- German banks occasionally confirm letters of credit issued by some of the African countries such as Ethiopia, Kenya etc. These credits are not originally issued in Germany, as a result possesses higher risk factors.

References:

- https://en.wikipedia.org/wiki/Germany

- https://www.deutschland.de/en/topic/business/why-is-the-german-economy-so-strong-seven-reasons

- https://corporatefinanceinstitute.com/resources/careers/companies/top-banks-in-germany/

- HypoVereinsbank · 2017 Annual Report, Page:8 https://www.hypovereinsbank.de/portal?view=/de/ueber-uns/investor-relations-en/reports.jsp

- https://en.wikipedia.org/wiki/BayernLB