Inspection in international trade can be defined as a process of checking the quality of goods against the contractual requirements.

Because, the importer and exporter are located in different countries, and they are usually living very away from each other, as a result it would not be feasible for the importer to send someone to check the quality of goods for each shipment.

If the importer (the applicant) is not able to send a person he trusts to the place of shipment, he can ask an internationally recognized inspection company, such as the Geneva-based Société Générale Surveillance (SGS) to perform the inspection required.

The applicant will instruct the inspection company as to the manner in which it is to check the goods and what they must look for. (1)

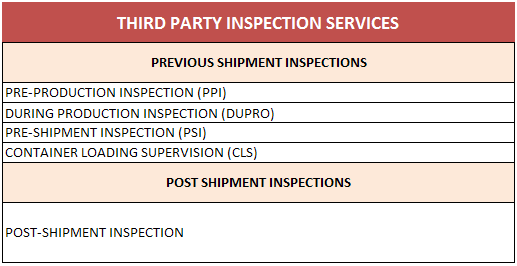

Third party inspection services in international trade can be grouped under two main categories.

- Previous Shipment Inspections, which are performed before the goods are shipped from the exporter’s factory and

- Post Shipment Inspections, which are performed after the goods are shipped from the exporter’s factory.

Inspections, which are performed before the goods are shipped from the exporter’s factory are as follows:

- Pre-Production Inspection (PPI)

- During Production Inspection (DUPRO)

- Pre-Shipment Inspection (PSI)

- Container Loading Supervision (CLS) or Container Loading Inspection (CLI)

Inspections, which are performed after the goods are shipped from the exporter’s factory are as follows:

- Post-Shipment Inspection (2)

Inspection certificate is the document that is issued by the inspection company after completion of the inspection. Inspection certificate provides data on the result of the inspection.

The inspection certificate should be issued by the party stated in the letter of credit.

According to the letter of credit rules and standard banking practices an inspection certificate, however named, must appear to be issued and signed by the entity stated in the letter of credit.

For example, if the letter of credit requires that pre-shipment inspection certificate should be issued by SGS, Intertek or CCIC Inspection Company, the inspection certificate that has been presented by the beneficiary must be issued and signed by one of these independent inspection companies.

If issuing bank finds out that an inspection certificate has not been issued and signed by the entity as required by the letter of credit, then the issuing bank will raise a discrepancy, which is known as inspection certificate not issued and signed by the party required by the letter of credit.

Letter of Credit Discrepancy Example: Inspection Certificate Not Issued and Signed by the Party Required by the Letter of Credit

A letter of credit has been issued in SWIFT format, subject to UCP latest version, with the following details:

Letter of Credit Conditions

Field 45A: Description of Goods and or Services: 20 mtons of %100 organic Italian Extra Virgin olive Oil. Delivery Terms: CIF Port of Newark, USA Incoterms 2010.

Field 46A: Documents Required:

- Beneficiary’s dated and manually signed commercial invoice in duplicates bearing full description of goods and its quantity, net and gross weight, unit and total price.

- Insurance policy covering all risks showing claims payable in USA.

- 3/3 full set original clean bills of lading made out to order of issuing bank, notify applicant company indicating freight prepaid stating the name, telephone and fax numbers of carrier’s agent in port of discharge. Bill of lading should evidence shipments made in refrigerated 40′ closed containers.

- The original inspection certificate issued not prior to marine bill of lading date by S.G.S or its authorized agent on S.G.S letter head certifying that the goods shipped/inspected are in conformity with the quality, quantity, and packing of the goods loaded are strictly complying with specifications of the goods indicated in the relative Purchasing Instruction, the terms of the l/c and all subsequent amendments as presented to S.G.S by the importer. The inspection certificate shall verify that the goods are in conformity with USDA organic food standards.

The beneficiary presented an insurance policy as shown on the below picture.

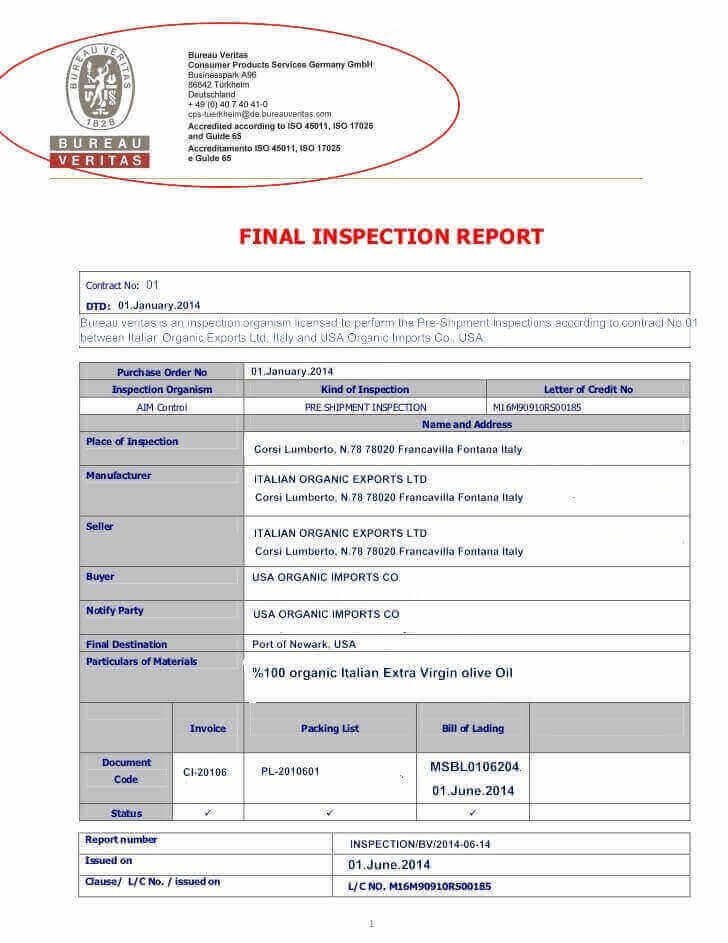

Inspection Certificate

Discrepancy: Inspection certificate should have been issued by S.G.S or its authorized agent on behalf of S.G.S inspection company. On the other hand, the inspection certificate has been issued by another inspection company.

Discrepancy: Inspection certificate should have been issued by S.G.S or its authorized agent on behalf of S.G.S inspection company. On the other hand, the inspection certificate has been issued by another inspection company.

Reason for Discrepancy: According to letter of credit rules and standard banking practices an inspection certificate, however named, must appear to be issued and signed by the entity stated in the letter of credit.

References:

- Documentary Credits in Practice, Second edition 2009, Nordea, Page:174, Reached: 07.March.2018

- What is a Pre-Production Inspection (PPI)?, www.advancedontrade.com, Reached: 07.March.2018