You should understand Netherlands economy, Netherlands exports and imports as well as Netherlands banks before you proceed to work with a letter of credit which is issued in Netherlands.

Economy of Netherlands and International Trade at a Glance:

- Gross domestic product of Netherlands is $770,60 billion US dollars in year 2012. This makes Netherlands economy 18th largest economy in the world after USA, China, Japan, Germany, France, United Kingdom, Brazil, Russia, Italy, India, Canada, Australia, Spain, Mexico, South Korea, Indonesia and Turkey.

- Netherlands is the world’s 10th biggest importer with 474,80 billion US dollars import volume in year 2012 and 7th biggest exporter with 538,50 billion US dollars export volume in year 2012.

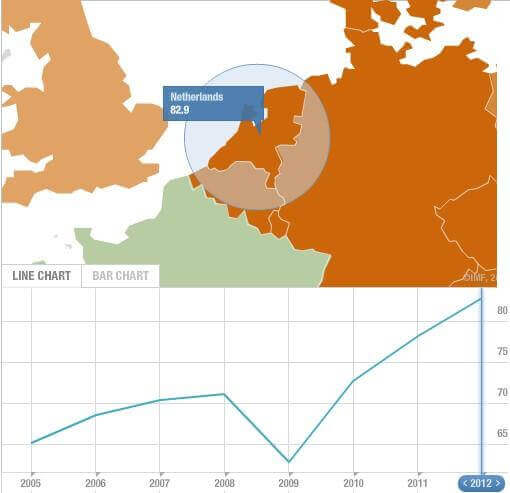

- International trade has been playing a significant role on Netherlands economy. Netherlands exports reached to 82,9% of its Gross Domestic Product in year 2012 according to IMF. These data show us that Netherlands is one of the most export oriented nations in the world.

Figure 1 : Netherlands Export of Goods and Services (percent of GDP) (Source :IMF)

Figure 1 shows Netherlands export of goods and services percent of GDP between 2005-2012. Netherlands exports / Netherlands GDP will be as follows for the corresponding years:

2005 : 65,2%

2006 : 68,7%

2007 : 70,5%

2008 : 71,3%

2009 : 62,9%

2010 : 72,8%

2011 : 78,2%

2012 : 82,9%

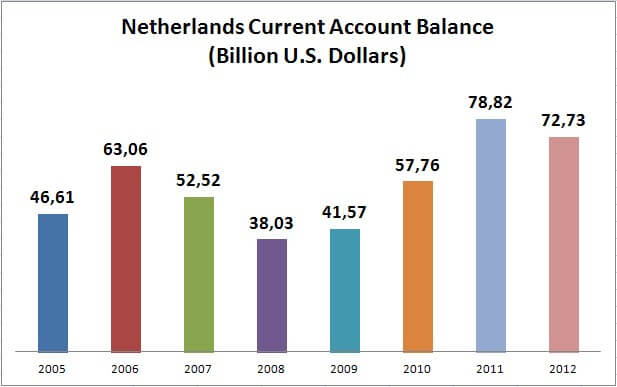

- Netherlands has a positive trade balance which means that its exports is higher than its imports. Even global economic crises could not change this positive trade balance status. Netherlands also has a positive current account thanks to its strong balance of trade surpluses. Current account is the sum of the balance of trade (i.e., net revenue on exports minus payments for imports), factor income (earnings on foreign investments minus payments made to foreign investors) and cash transfers.

Figure 2 : Netherlands Current Account Balance (Billion U.S. Dollars)

In year 2011 and 2012 Netherlands had a record high current account surpluses of 78,82 billion USD and 72,73 billion USD respectively.

- Main export products of Netherlands: Petroleum oils, refined (12%), Automatic data processing machines (3%), Petroleum oils, crude (3%), Medicaments, packaged (3%), Machines and mechanical appliances having individual functions(2%).

- Main import products of Netherlands: Petroleum oils, refined (9%), Petroleum oils, crude (5%), Automatic data processing machines (5%), Medicaments, packaged (3%), Cars (3%).

- Biggest Export Partners of Netherlands: Germany (19%), Belgium-Luxembourg (16%), United Kingdom (9%), France (6%), Italy (6%).

- Biggest Import Partners of Netherlands: Germany (16%), China (10%), Belgium-Luxembourg (10%), United States (7%), United Kingdom (6%).

Biggest Banks in Netherlands

ING Bank: ING (International Netherlands Group) is a global financial institution offering banking, investments, life insurance and retirement services.

ING’s operations are focused on its home Benelux market, as well as the rest of Europe, Asia/Pacific, and North America.

One of the world’s largest insurance and financial services companies. The Group was created in 1991 by a merger between Nationale-Nederlanden and NMB Postbank Group. At August 9, 2013, it had a market cap of over $43.0 billion.

Assets: 1.526,57 billion USD SWIFT Code: INGBNL2A

Rabobank Group: Rabobank is the market leader in Dutch retail savings, residential mortgages (31%), and SME banking.

It operates in 48 countries and serves approximately 10 million clients. Rabobank has the highest credit rating AAA from both Standard & Poor’s and Moody’s, and AA+ from Fitch.

Assets: 942 billion USD SWIFT Code: RABONL2U

ABN Amro Bank: ABN AMRO is a multinational universal bank servicing retail, private and commercial banking clients. ABN AMRO has a long and rich history reaching back almost 300 years.

The current structure of ABN AMRO Group is a result of various steps taken over the past period, ultimately resulting in the Legal Merger between ABN AMRO Bank and Fortis Bank Nederland as subsidiaries of ABN AMRO Group as at 1 July 2010.

The Dutch State holds all ordinary shares of ABN AMRO Group and has full control over ABN AMRO Group with a total financial interest of 97.8%. The remaining 2.2% is held by institutional investors via ABN AMRO Preferred Investments.

Assets: 531billion USD SWIFT Code: ABNANL2A