Understanding the Importance of a Draft Letter of Credit

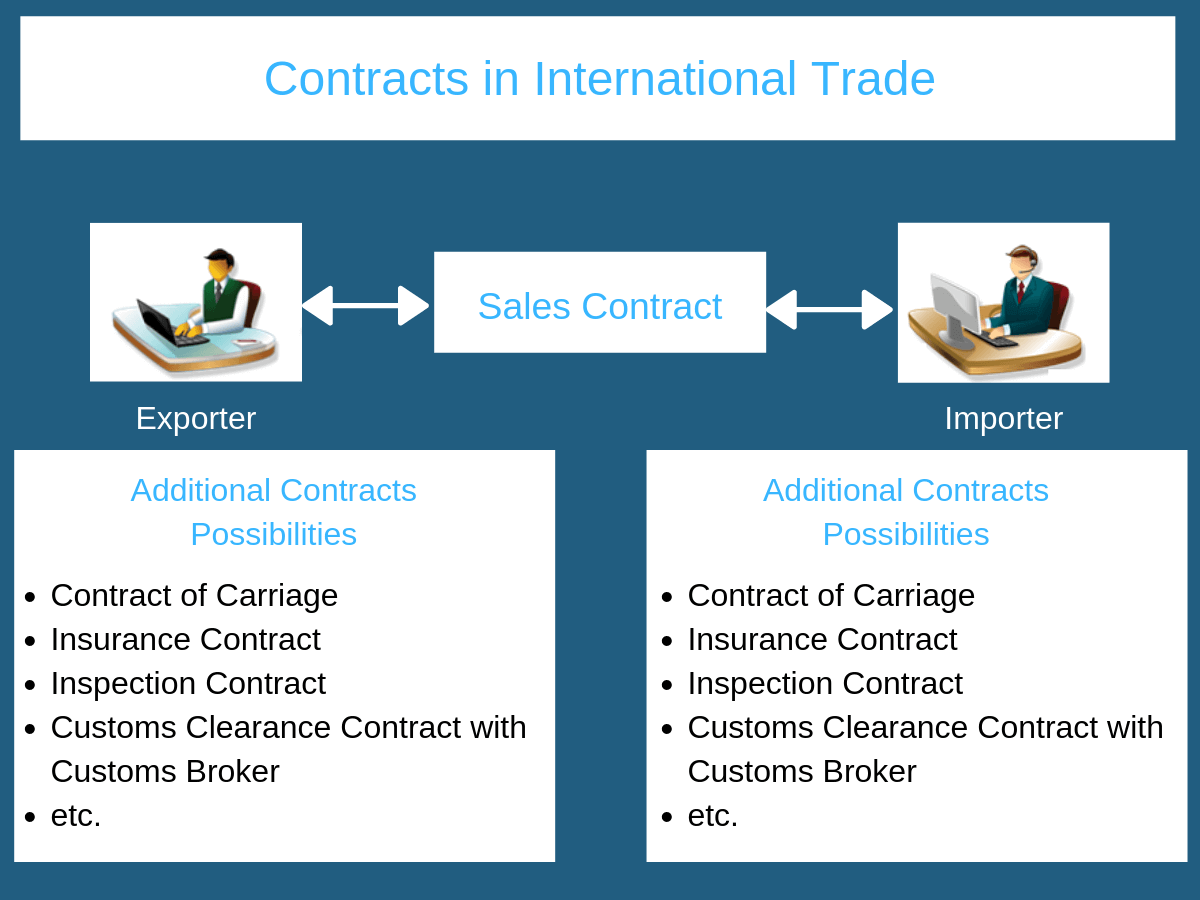

A letter of credit is a conditional payment method.

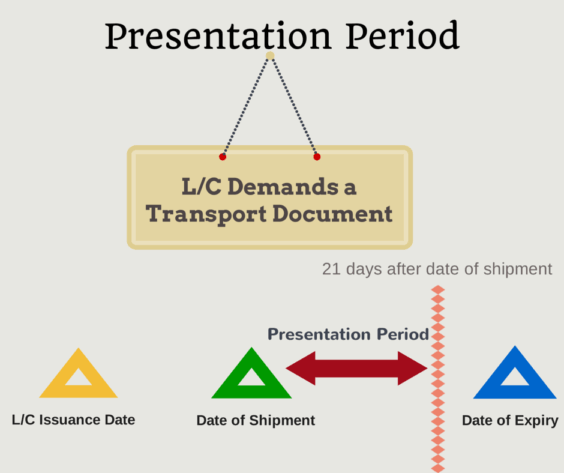

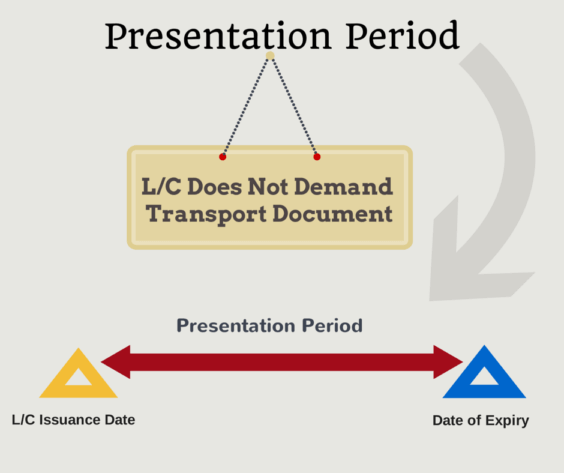

An exporter is required to submit documents, which comply with the letter of credit terms and conditions, to the issuing or confirming bank within the specified period allowed in order to receive payment under the letter of credit.

In case of discrepant documents, banks’ payment obligations will be diminished, and exporters can only receive payment if the discrepancies are accepted and cleared by the importers.

To avoid presenting discrepant documents, exporters usually check the letter of credit terms before starting production and request amendments to the letter of credit terms to correct potential issues that may arise.

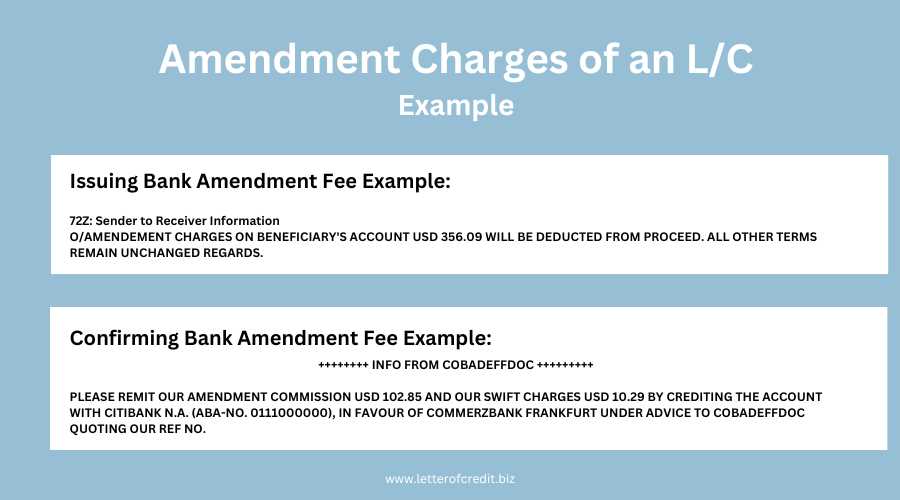

After an LC is opened in the Swift format, any amendments made to it are subject to an additional fee.

Almost all LCs include an amendment fee. This amendment fee is a cost that the issuing bank will collect.

In addition to the issuing bank, the advising bank also incurs a fee because it has transmitted the amendment message through the Swift system.

If the LC is confirmed and the confirming bank is different than the advising bank, then the confirming bank will also request a separate Swift message transmission fee for the amendment.

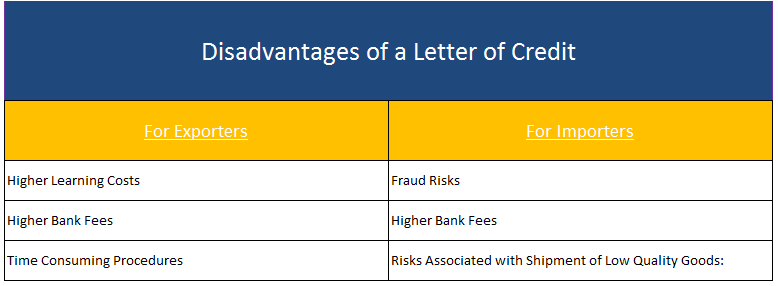

All these costs that may be requested by the issuing bank, advising bank, and confirming bank, if applicable, increase the operational cost of the LC.

The easiest way to avoid all these expenses is to request a draft letter of credit in swift format from the importer before opening the letter of credit.

What are the Differences Between a Draft Letter of Credit and a Letter of Credit?

The draft letter of credit, which is transmitted by the importer to the exporter in Swift format, should cover all details of the actual letter of credit to be opened.

As the letter of credit has not yet been opened, the letter of credit number should not be included in the draft.

In addition, the opening date of the letter of credit should not be mentioned in the draft letter of credit.

Except for these two points, all other information must be included in the draft letter of credit.

What is the Importance of a Draft Letter of Credit

The exporting company should review the draft letter of credit and communicate any necessary corrections to the importer.

The importer should then consult to the issuing bank and inform the exporter whether the requested corrections can be made.

The letter of credit should only be opened after both parties have agreed.

Opening letters of credit directly, without working on a draft letter of credit, can increase costs for the exporter and the operational difficulty level, resulting in additional discrepancy risks.

Summary:

A letter of credit is a conditional payment method that requires exporters to submit compliant documents to receive payment.

Discrepant documents can result in diminished payment obligations by the banks.

To avoid discrepancies, exporters usually check the letter of credit terms and request amendments if needed.

However, amendments made after the issuance of letter of credit come with additional fees, which can be costly for exporters.

To avoid these expenses, importers can provide a draft letter of credit in Swift format before opening the actual letter of credit.

The draft L/C should cover all details except for the letter of credit number and opening date.

Reviewing and correcting the draft letter of credit can help avoid discrepancies and increase operational efficiency.

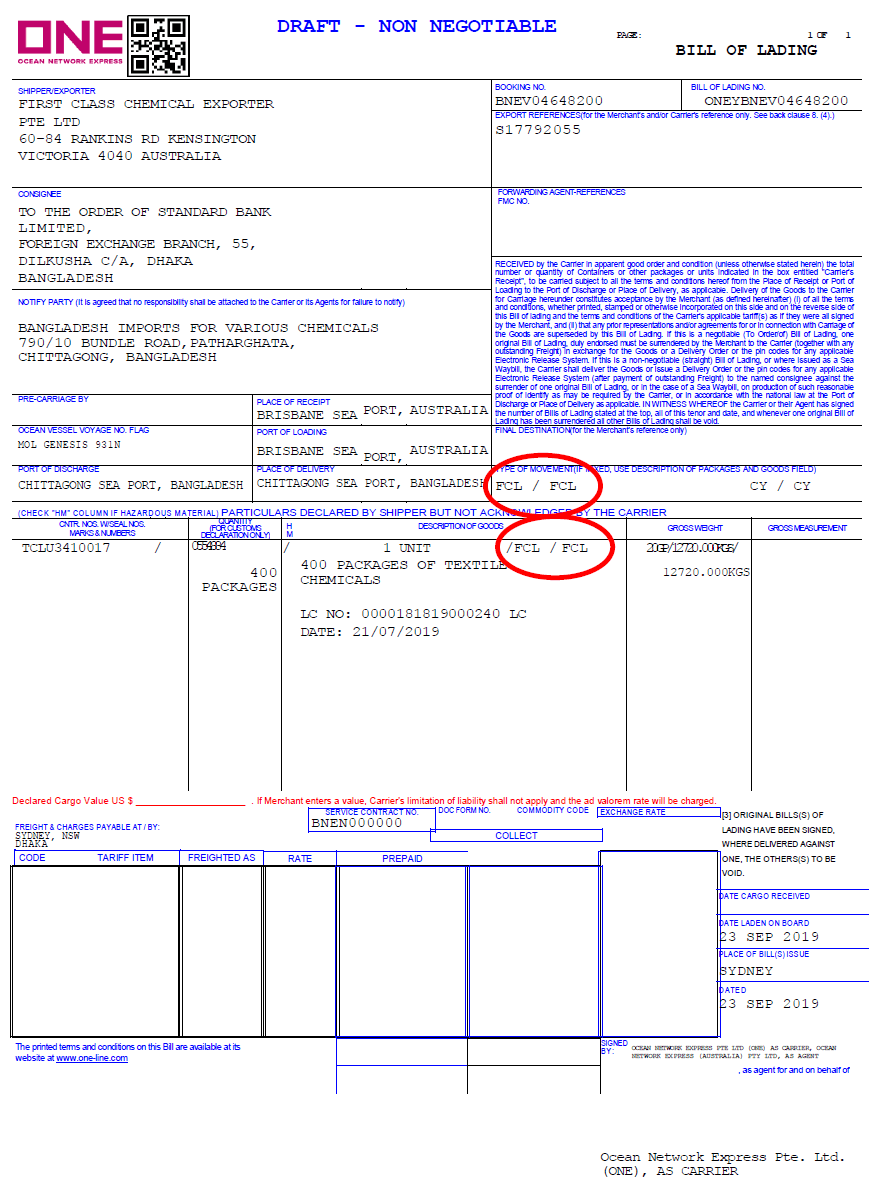

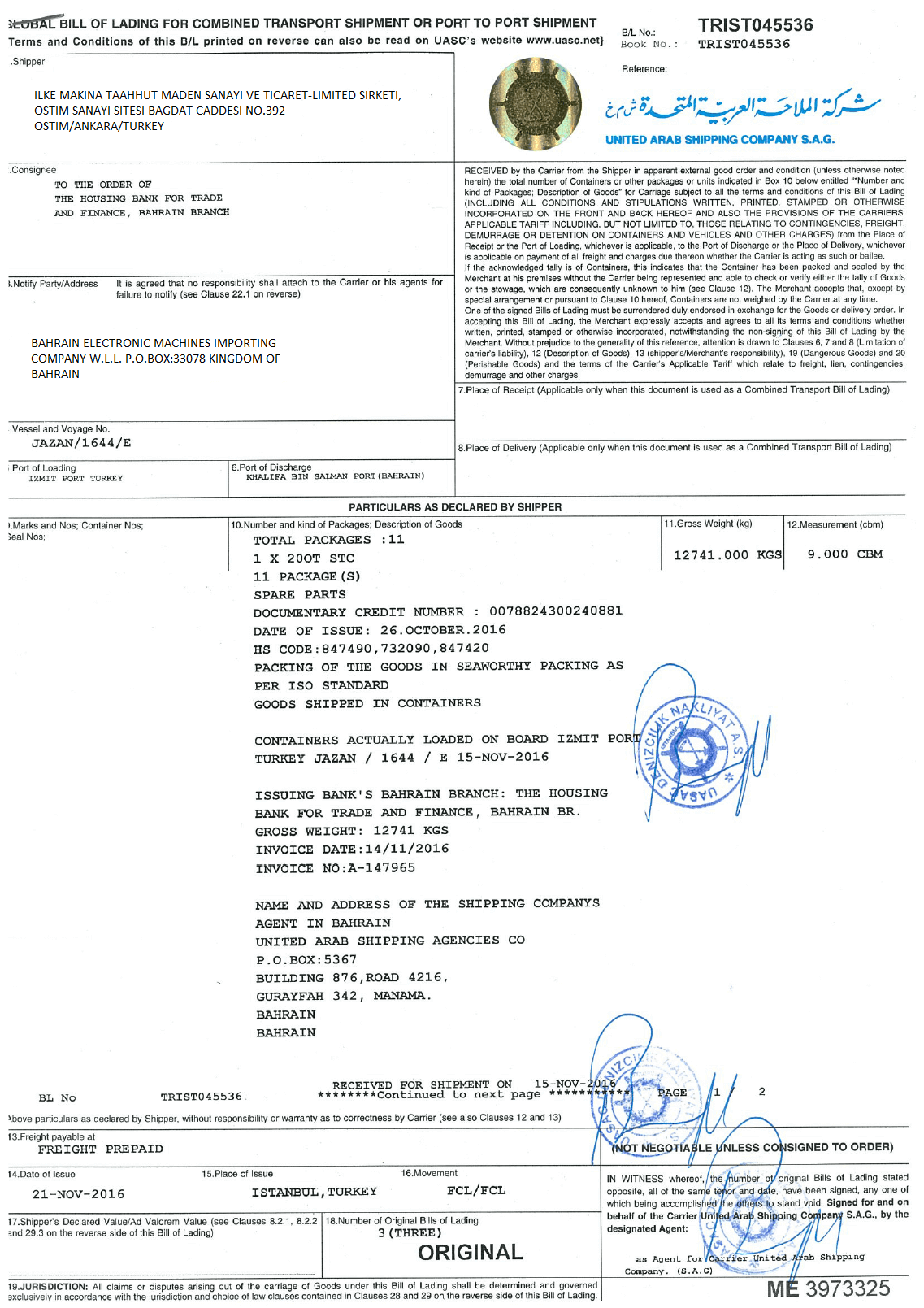

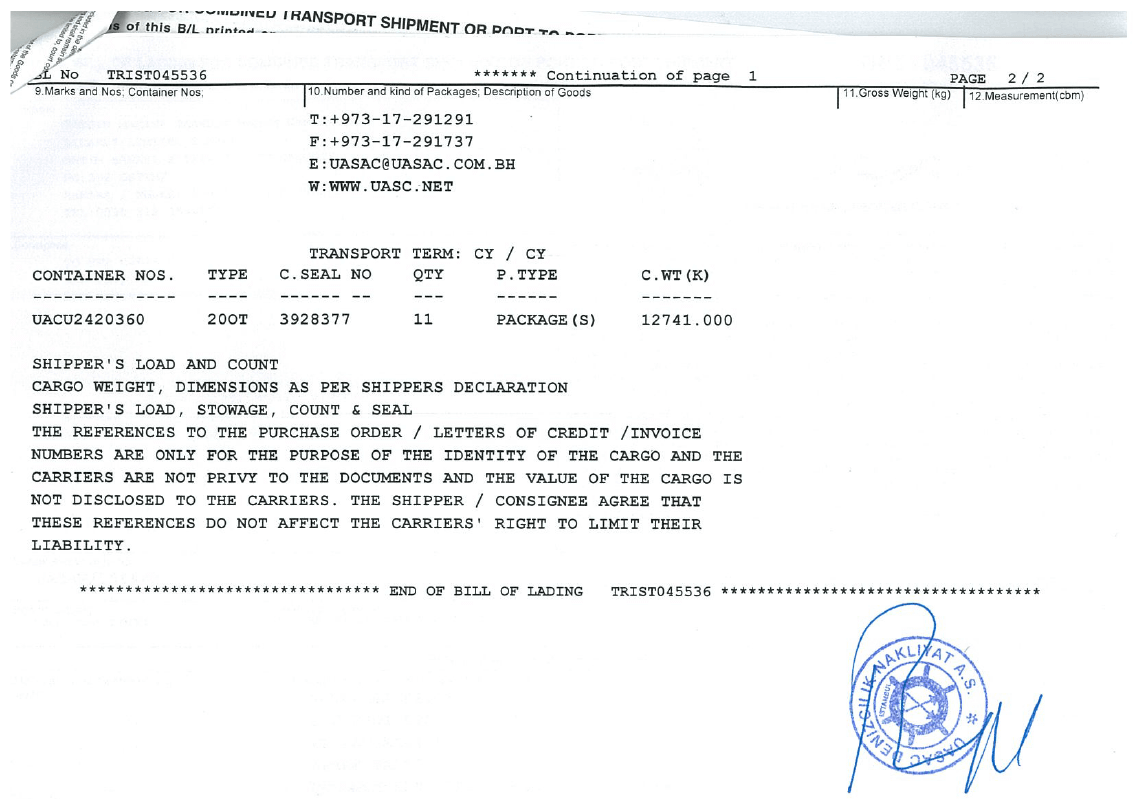

Draft Letter of Credit Example:

MESSAGE TYPE 700 ISSUE OF A DOCUMENTARY CREDIT ————————————————————————— FLD. TEXT CONTENTS —————————————————————————

27: SEQUENCE OF TOTAL:

1/1

40A: FORM OF DC:

IRREVOCABLE

20: DC NO:

DC ONYX0103207-DRAFT

31C: DATE OF ISSUE:

170215

40E: APPLICABLE RULES:

UCP LATEST VERSION

31D: EXPIRY DATE AND PLACE:

180331HONG KONG

50: APPLICANT:

CAMERA IMPORTER SA 7, RUE BARON 75000 PARIS,

FRANCE

TEL: 01 40 40 90 60 59:

BENEFICIARY:

CAMERA TRADING LTD 5/F HENG SHAN CTR 140 QUEEN’S ROAD EAST WINCHAI HONG KONG CHINA

32B: DC AMT:

USD1000000,00

39A: PERCENT.CRE. AMT TOLERANCE:

TOLERANCE 1 5 / TOLERANCE 2 5

41D: AVAILABLE WITH/BY:

ANY BANK IN HONG KONG BY NEGOTIATION

42C: DRAFTS AT:

180 DAYS AFTER SIGHT

42D: DRAWEE:

ISSUING BANK

43P: PARTIAL SHIPMENTS: ALLOWED

45A: DESCRIPTION OF GOODS:

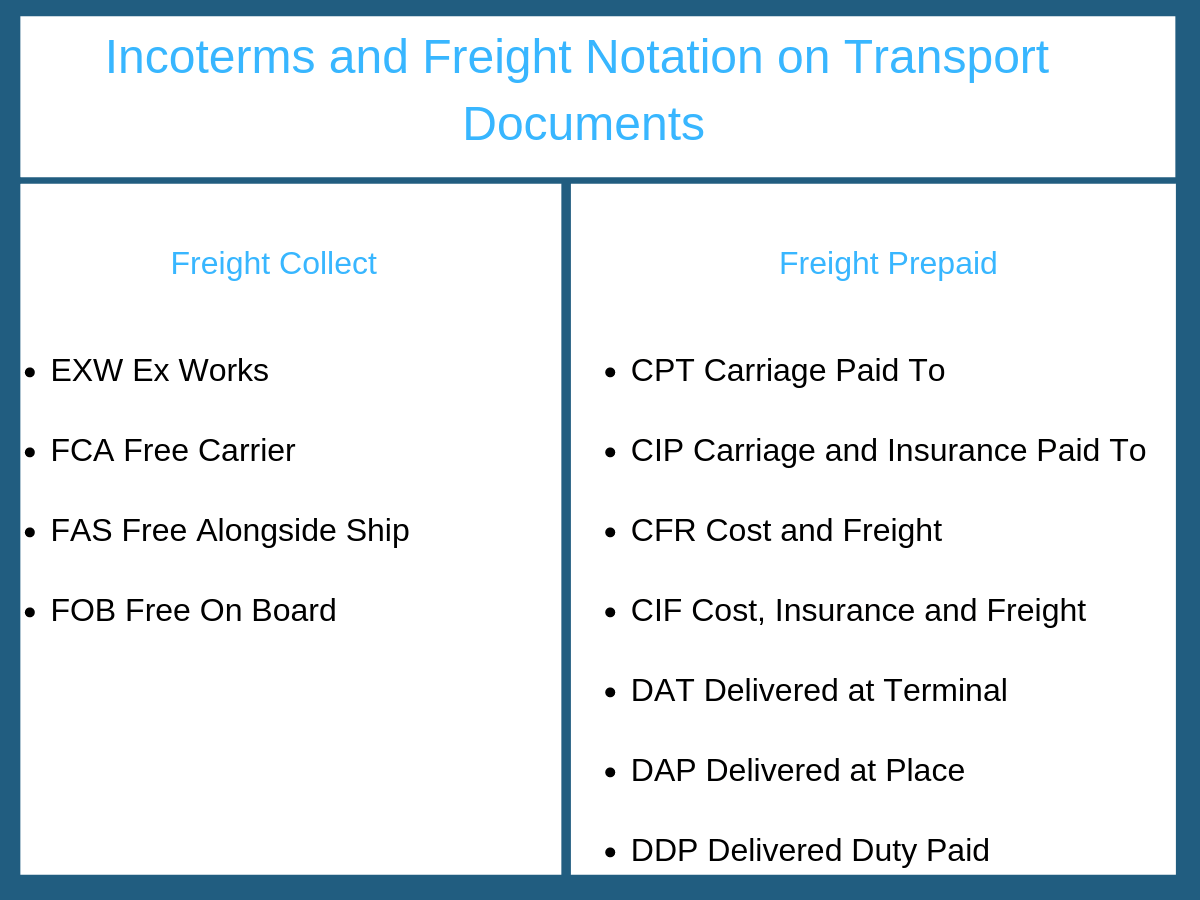

FCA (MANUFACTURER’S WAREHOUSE) CHINA, INCOTERMS 2010

+ SUPPLY OF

1. CAMERA WIFI 4K 10FPS PHOTO 16M LCD, QUANTITY: 3000PCS,

2. ACTION CAMS, QUANTITY: 1000PCS

AS PER APPLICANT’S PURCHASE ORDER NO. F1700016 DATED 23.02.2017.

46A: DOCUMENTS REQUIRED:

1. USD 300.000,00 PAYABLE AS ADVANCE PAYMENT AGAINST PRESENTATION OF THE FOLLOWING DOCUMENT:

1.1) BENEFICIARY’S SIMPLE RECEIPT FOR ADVANCE PAYMENT ISSUED ON BENEFICIARY’S LETTERHEAD AND DULY SIGNED AND STAMPED BY THE BENEFICIARY. 2. USD 700.000,00 PAYABLE AT 180 DAYS SIGHT AGAINST PRESENTATION OF THE FOLLOWING DOCUMENTS:

2.1) SIGNED COMMERCIAL INVOICES IN ONE ORIGINAL PLUS TWO COPIES STATING THAT GOODS ARE AS PER APPLICANT’S PURCHASE ORDER NO. F0000000 DATED 23.02.2017. THE COMMERCIAL INVOICE MUST SHOW 100 PCT. VALUE OF GOODS SHIPPED, LESS ADVANCE PAYMENT DEDUCTION AS PER CLAUSE NO. 3 OF FIELD 47A.

2.2) PACKING LIST IN TRIPLICATE.

2.3) CERTIFICATE OF ORIGIN ISSUED BY THE CHAMBER OF COMMERCE OR BENEFICIARY.

2.4) ONE ORIGINAL OF FIATA FCR (FORWARDERS CERTIFICATE OF RECEIPT) ISSUED BY (XYZ FREIGHT FORWARDER COMPANY) CONSIGNED TO APPLICANT CERTIFYING THAT HAVING ASSUMED CONTROL OF THE ABOVE-MENTIONED CONSIGNMENT IN EXTERNAL APPARENT GOOD ORDER AND CONDITION WITH IRREVOCABLE INSTRUCTIONS TO BE FORWARDED TO THE CONSIGNEE.

2.5) BENEFICIARY’S CERTIFICATE STATING THAT PRE-SHIPMENT INSPECTION HAS BEEN CARRIED OUT BY AN INDEPENDENT INTERNATIONAL INSPECTION COMPANY BEFORE SHIPMENT AND THE INSPECTION REPORT HAS BEEN EMAILED TO THE APPLICANT. THE INSPECTION REPORT HAS BEEN CHECKED, VERIFIED AND ACCEPTED BY THE APPLICANT.

47A: ADDITIONAL CONDITIONS:

1.TOLARANCE +/-5 IN QUANTITY AND TOTAL AMOUNT IS ACCEPTABLE PER EACH INSTALLMENT DRAWINGS AS EXPLAINED UNDER FIELD 47A-CLAUSE 3.

2.PARTIAL DRAWINGS ARE ACCEPTABLE

3.INSTALLMENT DRAWINGS 3.1) FIRST DRAWING MUST BE COMPLETED BETWEEN 01.MAY.2017 TO 30.JUNE.2017 WITH THE SHIPMENTS OF ARTICLE 1 3.2) SECOND DRAWING MUST BE COMPLETED BETWEEN 01.JANUARY.2018 TO 31.MARCH.2018 WITH THE SHIPMENTS OF ARTICLE 2.

71B: DETAILS OF CHARGES:

ALL CHGS OUTSIDE COUNTRY OF ISSUE FOR ACCOUNT OF BENEFICIARY/EXPORTER

48: PERIOD OF PRESENTATION:

EACH DRAWING MUST BE COMPLETED ACCORDING TO TIME FRAMES EXPLAINED UNDER FIELD 47A-CLAUSE 3.

49: CONFIRMATION INSTRUCTIONS:

WITHOUT

78: INFO TO PRESENTING BK:

* MUST BE COMPLETED BY THE ISSUING BANK